The Of Not For Profit

Table of ContentsNon Profit Organizations List Fundamentals ExplainedExcitement About Not For Profit Organisation501 C Fundamentals ExplainedExcitement About Npo RegistrationExamine This Report on 501c3Non Profit Organizations List Fundamentals ExplainedAll about Non Profit OrgThe Of Non Profit Organizations Near Me501c3 - An Overview

Integrated vs - 501c3 nonprofit. Unincorporated Nonprofits When people consider nonprofits, they normally consider incorporated nonprofits like the American Red Cross, the American Civil Liberties Union Foundation, and also various other formally created companies. However, several people take part in unincorporated nonprofit associations without ever before recognizing they've done so. Unincorporated nonprofit organizations are the outcome of 2 or more individuals working together for the purpose of providing a public advantage or service.Exclusive foundations might include family members foundations, exclusive operating foundations, and also corporate structures. As noted over, they generally don't use any services and also instead utilize the funds they elevate to sustain other philanthropic organizations with service programs. Personal foundations likewise tend to require more start-up funds to develop the organization along with to cover legal costs and various other ongoing expenditures.

All About 501 C

The possessions continue to be in the count on while the grantor is to life as well as the grantor may manage the assets, such as dealing supplies or property. All possessions deposited right into or bought by the trust continue to be in the trust fund with income distributed to the assigned recipients. These counts on can make it through the grantor if they consist of a provision for continuous management in the documentation made use of to establish them.

Fascination About Non Profit Organizations Near Me

You can hire a depend on lawyer to help you create a philanthropic trust and also encourage you on how to handle it relocating onward. Political Organizations While a lot of various other kinds of not-for-profit organizations have a limited capability to participate in or advocate for political task, political companies operate under different policies.

Fascination About Npo Registration

As you evaluate your alternatives, make certain to seek advice from a lawyer to establish the most effective strategy for your company and also to ensure its proper configuration.

There are several types of not-for-profit companies. All assets and also earnings from the nonprofit are reinvested right into the organization or contributed.

The Google For Nonprofits Ideas

In the United States, there are around 63,000 501(c)( 6) companies. Some instances of popular 501(c)( 6) organizations are the American Ranch Bureau, the National Writers Union, and also the International Association of Satisfying Coordinators. 501(c)( 7) - Social or Recreational Club 501(c)( 7) companies are social or entertainment clubs. The function of these nonprofit organizations is to arrange activities that cause pleasure, recreation, as well as socializing.

Non Profit Organizations List Things To Know Before You Buy

501(c)( 14) - State Chartered Credit Score Union and Mutual Reserve Fund 501(c)( 14) are state chartered debt unions and shared get funds. These companies provide economic solutions to their members and also the area, normally at reduced prices.

In order to be eligible, at the very least 75 percent of members need to be existing or previous members of the USA Armed Forces. Funding originates from donations and also federal government gives. 501(c)( 26) - State Sponsored Organizations Offering Wellness Protection for High-Risk People 501(c)( 26) are not-for-profit companies produced at the state level to provide insurance policy for high-risk people who might not be able to get insurance policy via other ways.

How Npo Registration can Save You Time, Stress, and Money.

Funding originates from donations or government gives. Examples of states with these high-risk insurance policy swimming pools are North Carolina, Louisiana, and Indiana. 501(c)( 27) - State Sponsored Workers' Compensation Reinsurance Organization 501(c)( 27) nonprofit companies are produced to provide insurance for workers' payment programs. Organizations that supply employees settlements are needed to be a member of these organizations and pay fees.

A nonprofit firm is a company whose function is something aside from making a revenue. non profit. A not-for-profit contributes its income to attain a specific objective that benefits the general public, rather than distributing it to shareholders. There more than 1. 5 million nonprofit organizations registered in the local nonprofits United States. Being a nonprofit does not mean the organization won't make a profit.

The Non Profit Statements

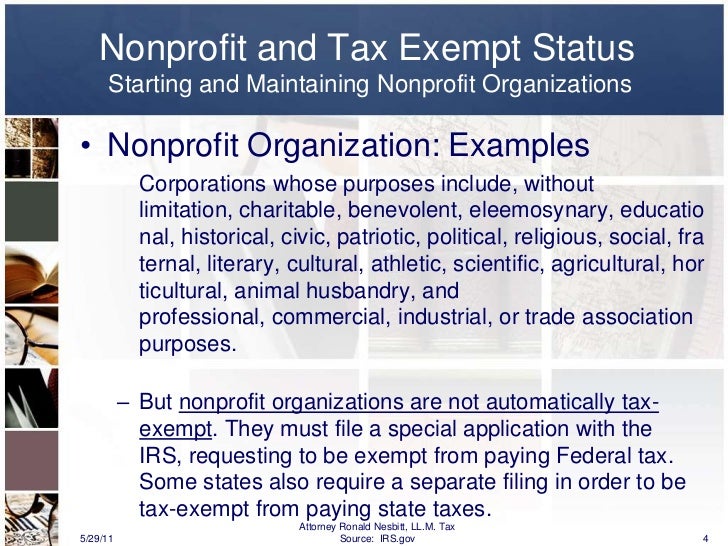

Nobody person or group owns a nonprofit. Possessions from a nonprofit can be marketed, yet it benefits the entire company instead of individuals. While anybody can integrate as a nonprofit, only those look at here who pass the rigorous criteria stated by the federal government can accomplish tax obligation exempt, or 501c3, standing.

We talk about the actions to becoming a nonprofit further into this page.

Not known Details About Not For Profit

One of the most vital of these is the ability to acquire tax obligation "exempt" standing with the IRS, which allows it to get donations devoid of gift tax, enables benefactors to deduct contributions on their income tax obligation returns and also exempts some of the company's tasks from earnings taxes. Tax excluded status is vitally vital to numerous nonprofits as it urges contributions that can be made use of to support the goal of the organization.